Introduction

There are several order settings that you can configure that will allow you to control when and how your customers points balances will be calculated on their purchases.

- Order Settings

- Shopify tax settings & points calculation

- How to reward for POS orders

Order Settings

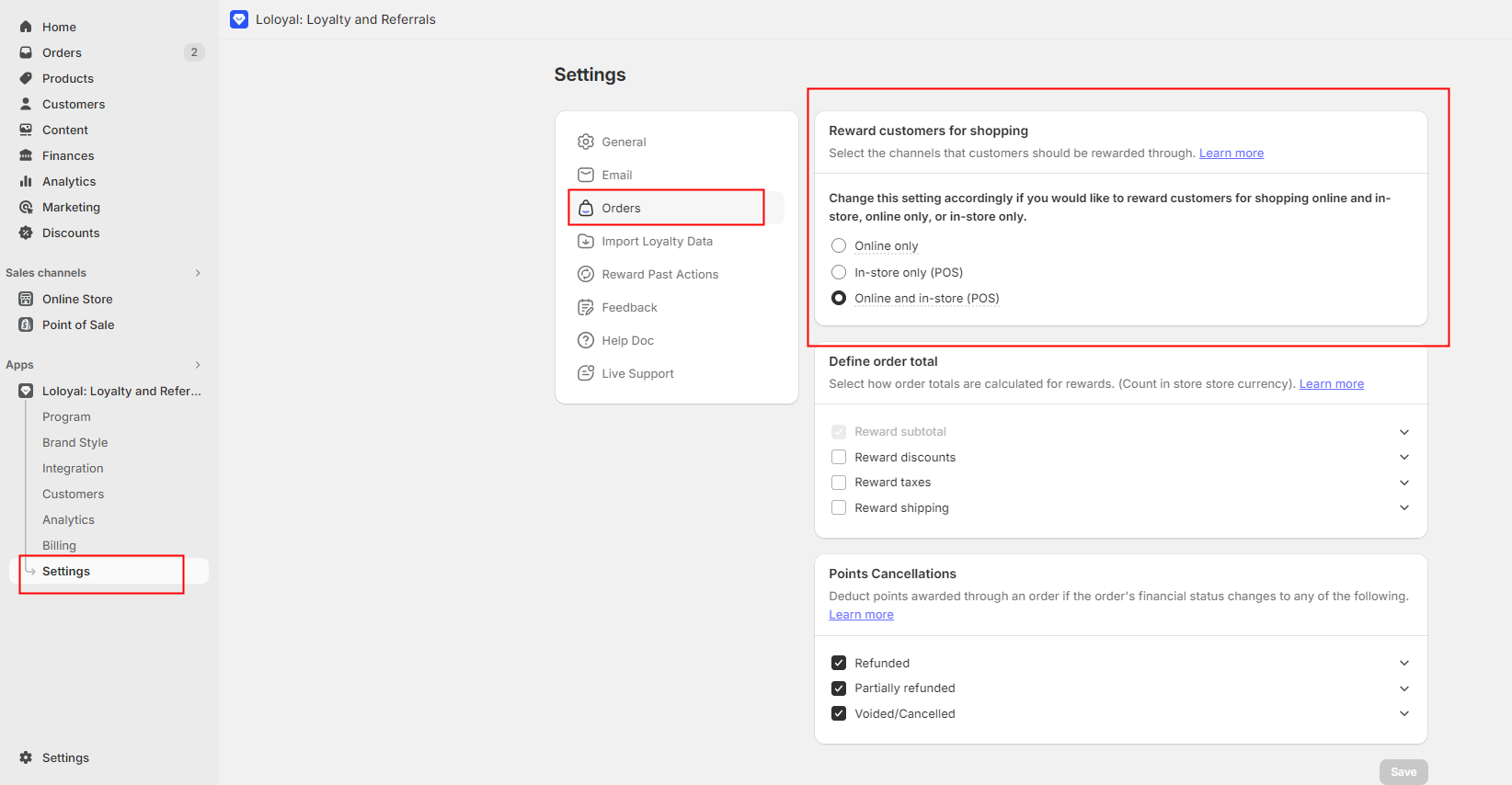

From the dashboard, go to Settings > Orders.

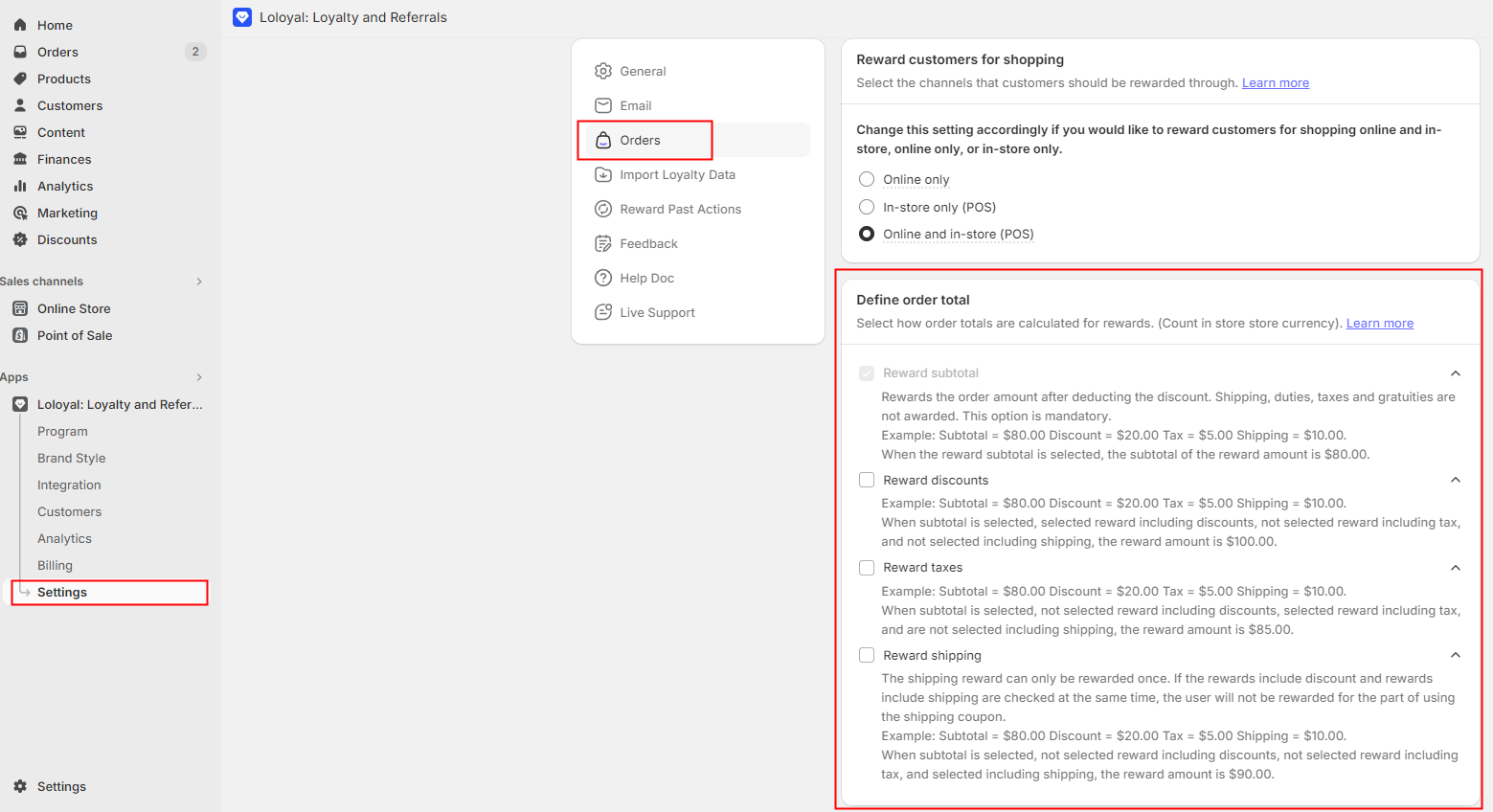

Reward subtotal:

Rewards the order amount after deducting the discount. Shipping, duties, taxes and gratuities are not awarded. This option is mandatory.

Example: Subtotal = $80.00 Discount = $20.00 Tax = $5.00 Shipping = $10.00.

When the reward subtotal is selected, the subtotal of the reward amount is $80.00.Reward discounts:

Example: Subtotal = $80.00 Discount = $20.00 Tax = $5.00 Shipping = $10.00.

When subtotal is selected, selected reward including discounts, not selected reward including tax, and not selected including shipping, the reward amount is $100.00.Reward taxes:

Example: Subtotal = $80.00 Discount = $20.00 Tax = $5.00 Shipping = $10.00.

When subtotal is selected, not selected reward including discounts, selected reward including tax, and are not selected including shipping, the reward amount is $85.00.Reward shipping:

Example: Subtotal = $80.00 Discount = $20.00 Tax = $5.00 Shipping = $10.00.

When subtotal is selected, not selected reward including discounts, not selected reward including tax, and selected including shipping, the reward amount is $90.00.

Shopify tax settings & points calculation

Briefly, Shopify's tax settings work like this:

- If All prices include tax = checked, the tax is included in the price that the customer sees. If your product is $20, the customer pays $20 + any shipping at checkout.

- If All prices include tax = unchecked, the relevant tax is calculated and added at checkout. So, for a $20 product, the customer pays $20 + any tax + any shipping at checkout.

Below is a breakdown of how points are calculated depending on how you have configured your Shopify setting. All prices include tax and our app’s setting Include taxes for points calculated on orders. In all of the examples below, the price of the product is $20 and the customer earns 1 point for every $1 spent on orders. For the sake of clarity the shipping in each example is free.

Prices include tax and points calculation includes tax

If your store's prices already include tax and you have set our app to include tax when points are calculated, points will be calculated based on the order subtotal.Prices include tax and points calculation excludes tax

If your store's prices already include tax and you have set our app to exclude tax when points are calculated, points will be calculated based on the order subtotal minus the included tax.Prices do not include tax and points calculation includes tax

If your store's prices do not include tax and you have set our app to include tax when points are calculated, points will be calculated based on the order subtotal plus the tax added at checkout.Prices do not include tax and points calculation excludes tax

If your store's prices do not include tax and you have set our app to exclude tax when points are calculated, points will be calculated based on the order subtotal, before the tax is added at checkout.

How to reward for POS orders

Change this setting accordingly if you would like to reward customers for shopping online and in-store, online only, or in-store only.